3PL or third-party fulfillment company provides vital services to eCommerce businesses. They can track inventory, reach out to suppliers, manage the fulfillment process, and route everything through a single system. Cost of Manufactured Goods – The Cost of Manufactured Goods is the number you ultimately want to discover by using work in process inventory and other costs as variables.

- The 3PL’s inventory management system will give you accurate inventory counts at different times, which can be bolstered by on-demand physical counts to ensure accuracy during key accounting periods.

- Count units in person for smaller production runs; rely on data from production monitoring systems for larger, widely dispersed operations.

- Either stored in the production area or a buffer storage area, the work-in-process inventory is kept at a minimum since overflow can interfere with production.

- Whenever these terms are describing a physical product being sold, their meaning is the same.

- Vendor managed inventory agreements are often helpful in determining the right purchase orders to protect against supply chain surprises.

- The cost of raw materials is the first cost incurred in this process because materials are required before any labor costs can be incurred.

Danielle Smyth is a writer and content marketer from upstate New York. In addition to this content, she has written What Is Work In Process Wip Inventory & How To Calculate It-related articles for sites like Sweet Frivolity, Alliance Worldwide Investigative Group, Bloom Co and Spent. Most often used in construction, work-in-progress inventory calculates completion percentages, so clients are billed accordingly. It allows the company to earn a percentage at each stage until they earn their full amount. Calculating the cost of WIP inventory is much more complex than calculating the value of the finished goods due to more intricate, moving parts. Here are some terms and calculations to achieve a better grasp of WIP inventory value. Another reason to classify WIP inventory is that it’s a significant factor in the valuation of your business.

How to Calculate Construction Overtime

As soon as they are pulled from the back room onto the factory floor (or into your hands if you’re making the hats yourself) they become Work in Process inventory. Work in Process, much like the commonly used phrase “work in progress,” is work that has been started but is not yet finished. WIP inventory, then, is inventory that is currently being used to manufacture something.

Transcript : AXT, Inc., Q4 2022 Earnings Call, Feb 16, 2023 – Marketscreener.com

Transcript : AXT, Inc., Q4 2022 Earnings Call, Feb 16, 2023.

Posted: Thu, 16 Feb 2023 21:30:00 GMT [source]

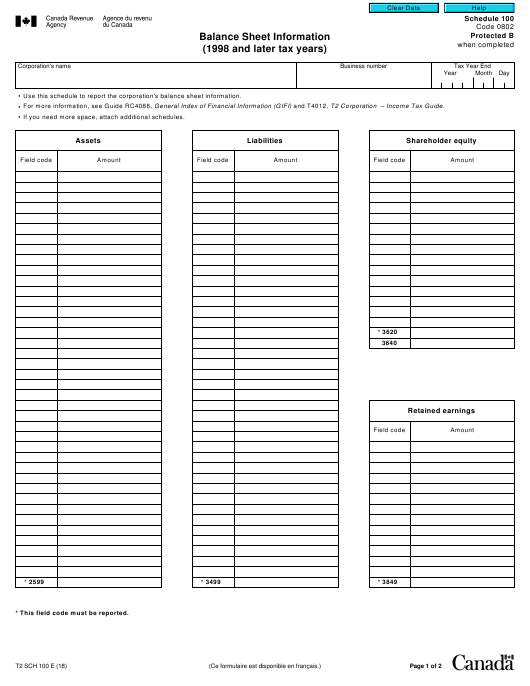

The current cycle’s beginning WIP inventory cost should be the exact same as the last cycle’s ending WIP inventory cost. Any inventory that moves from raw materials and is manipulated by human or machine labor, but is not yet a complete product, is considered to be work-in-process inventory. For example, suppose a company’s beginning WIP inventory costs $15,000, their manufacturing costs $50,000 and their cost of finished goods is $45,000. Work-in-process inventory is calculated at the end of each accounting period. This figure is the ending work-in-process inventory for that quarter, year or whichever accounting period.

Work-In-Process Inventory Formula

In supply-chain https://personal-accounting.org/, work-in-progress refers to goods that are partially completed. This covers everything from the overhead costs to the raw materials that come together to form the end product at a given stage in the production cycle. In accounting, WIP is considered a current asset and is categorized as a type of inventory. However, costs are incurred throughout the period and must be accounted for. Whenever any wood is taken and used to build the chair the cost of that wood is a debit to the work-in-process inventory and a credit to the raw materials inventory.

How do you calculate total cost on WIP?

- Percent Complete = Cost of Revenues To Date / Total Estimated Contract Cost.

- Contract Amount X Percent Complete = Total Earned Revenues.

- Total Earned Revenues – Total Cost of Revenues = Gross Profit.

- Total Earned Revenues – Total Billings To Date = Under(Over) Billing.

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Most merchants calculate their WIP inventory at the end of a reporting period (end of quarter, end of year, etc.), and are looking for their “ending WIP inventory”. To calculate ending WIP inventory, you need beginning WIP inventory, which is the previous reporting period’s ending WIP inventory. Shorter WIP Stage → The quicker the inventory cycles out (i.e. as part of the cash conversion cycle), the more free cash flow there tends to be since the cash is not merely sitting as inventory.

Trust the Process

These 5 completed tables will be included in the finished goods inventory and ready to be sold. The second metric to calculate the current WIP inventory is the manufacturing cost. This is the cost of all raw materials and labor involved in making a product. At this stage, you have products that are unfinished and therefore cannot be sold. Any product that’s at this point of the manufacturing process is factored in here.

Minimizing WIP inventory before reporting it is both standard and necessary since it is difficult to estimate the percentage of completion for an inventory asset. You work with multiple suppliers to source materials then send them to a manufacturer to assemble your finished goods. WIP stands for “work in progress” and refers to any partially complete inventory not yet ready to be sold to customers. Understanding WIP inventory can be challenging, especially since it consists of many moving parts during the production process. High levels of inventory can be an issue because it is expensive to store, you might run out of storage space, and there is the risk of obsolescence if the product has a short lifespan. Even if a company has a small WIP footprint, and a short production cycle, manual and spreadsheet-based programs become unwieldy as the company grows.